Federal withholding calculator 2020

How to Calculate Federal Income Tax. However due to federal tax law and form changes the federal form no longer calculates Oregon withholding correctly.

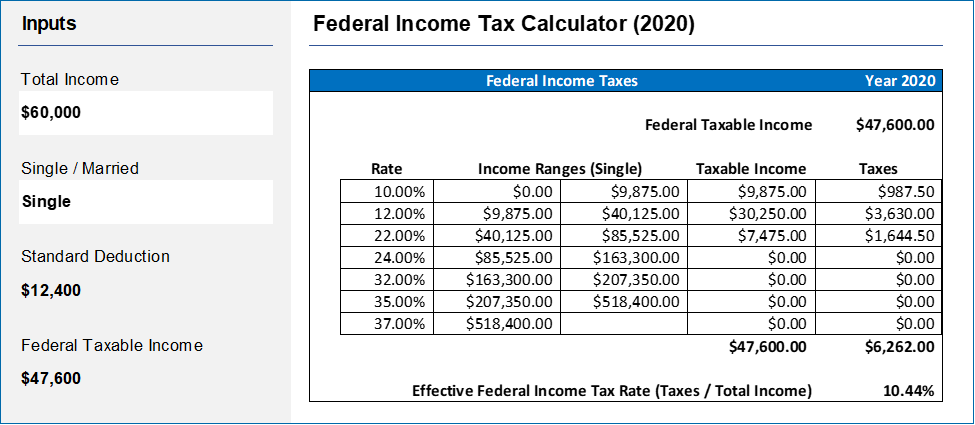

Inkwiry Federal Income Tax Brackets

Maximize your refund with TaxActs Refund Booster.

. Now you can easily create a Form W-4 that reflects your planned tax withholding amount. One of the major recommendations from the IRS is to use a W4 withholding calculator to perform what they refer to as a paycheck checkup. Eral Form W-4 to determine and claim Oregon withholding.

Of Federal Allowances. Since these payments are subject to federal withholding Virginia income tax must also be withheld. 2020 2021 2022 calculator w4 withholding.

Exempt from Federal. But for 2020 Forms W-4 and later employees can lower their tax withholding by claiming dependents or using the deductions worksheet on the form. File taxes online Simple steps.

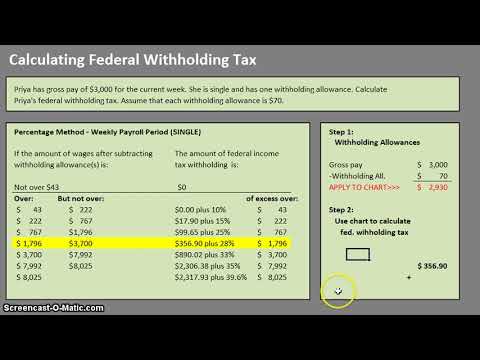

Estimate your paycheck withholding with our free W-4 Withholding Calculator. The IRS also provides a federal tax calculator for withholding each year. Your employer withholds from your paycheck based on the information you fill in on your Form W-4.

202223 Tax Refund Calculator. The Oklahoma salary calculator will calculate. Note that allowances wont be used to calculate paycheck withholding on Form W-4 starting in 2020.

The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. Since employers will also have to withhold based on existing Forms W-4 the computations in Pub 15-T will allow employers to figure withholding regardless of whether the employee has a Form W-4 from an earlier. Submit or give Form W-4 to your employer.

Federal Filing Status. Forms W-4 that are submitted to your employer after January 1 2020 cant be used to calculate Oregon with-holding. Check out our W-4 withholding paycheck calculator.

Online Tax Filing is Open. Instead use Form OR-W-4 to help you calculate. Use the 2021 tables to figure out how much tax you need to withhold from an employees income.

This form is used to record employee information for calculating withholding and deductions. This is your income that remains after any pre-tax deductions are made. Note theres a different process depending on if the employee has a new W-4 2020 and later or an old W-4 2019 and earlier.

The amount of income tax your employer withholds from your regular pay depends on two things. Employer Federal Income Tax Withholding Tables 2021 is out now. Starting in 2020 the IRS will release the new Publication 15-T which includes the federal income tax withholding methods and table.

To determine the correct federal tax withheld from your pay you will need to complete your W-4. Of Federal Allowances. California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll.

The Colorado salary calculator will show you how much income. 10 12 22 24 32 35 and 37. Any payments reportable for federal purposes are also reportable for Virginia purposes.

Home - W-4 Withholding Calculator. For employees withholding is the amount of federal income tax withheld from your paycheck. IRS Form W-4 has been changed effective Jan.

Taxable income 87450 Effective tax rate 172. Yes Oklahomas personal income tax is a progressive tax system. Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form.

Most taxpayers will have 62 withheld for Social Security 145 for Medicare and federal income taxes withheld from their taxable incomes. More details about the Tax Withholding Estimator and the new 2020. The federal withholding tax has seven rates for 2021.

Youll be able to determine if you are exempt from federal withholding here. IRS Publication 15-T 2020 Tax Withholding Tables 2020 Download. Does Virginia also allow these amounts to be.

Since early 2020 any change made to state withholding must be made on Form OR-W-4 as the new federal Form W-4 cant be used for Oregon withholding purposes. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. To change your tax withholding amount.

Individuals can use this tax calculator. This all depends on whether youre filing as single married jointly or married separately or head of household. In the past employees could claim more allowances to lower their FIT withholding.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Under federal law I am allowed to exclude group life insurance premium payments from taxable wages. Kentucky Storm Flooding Victims Now Eligible for Tax Relief.

You dont need to do anything at this time. H and R block Skip to content. IRS Federal Income Tax Form 1040A.

Use the IRS Tax Withholding Estimator to make sure you have the right amount of tax withheld from your paycheck. Instead the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine. If the return is not complete by 531 a 99 fee for federal and 45 per state.

Ask your employer if they use an automated system to submit Form W-4. Previously filed Oregon or federal withholding statements Form OR-W-4 or Form W-4 which are used for Oregon withholding can remain in place if the taxpayer doesnt change their. Be sure you are using the correct form titled Employees Withholding Certificate with the current year in the upper right.

All residents pay the same flat income tax rate. To keep your same tax withholding amount. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year.

Kansas Income Tax Calculator. Federal Filing Status. 2021 2022 Paycheck and W-4 Check Calculator.

How to Calculate Federal Income Tax Withholdings. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck.

In 2022 the federal income tax rate tops out at 37. The Paycheck Calculator below allows employees to see how these changes affect pay and withholding. Federal income tax is usually the largest tax deduction from gross pay on a paycheck.

The federal withholding tax rate an employee owes depends on their income level and filing status. The federal withholding rate depends on your filing status and taxable income. IRS tax forms.

It is levied by the Internal Service Revenue IRS in order to raise revenue for the US. Offer valid for returns filed 512020 - 5312020. The IRS has an Income Tax Withholding Assistant calculator on their website that employers can use to.

The withholding calculator can help you figure the right amount of withholdings. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Only the highest earners are subject to this percentage.

Electronic Filing of.

How To Calculate Federal Withholding Tax Youtube

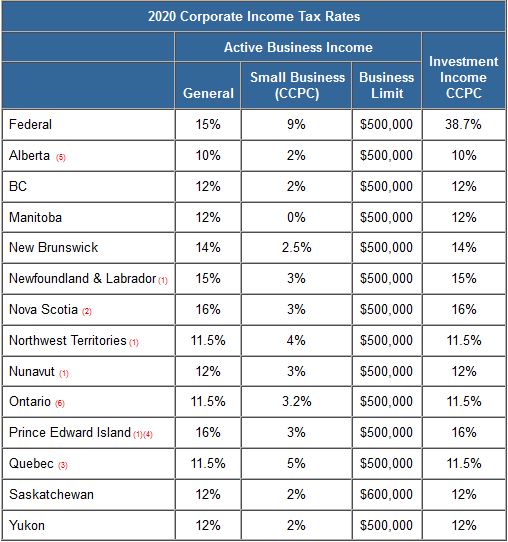

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Payroll Taxes Methods Examples More

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Income Tax In Excel

How To Calculate Federal Income Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Ontario Income Tax Calculator Calculatorscanada Ca

Excel Formula Income Tax Bracket Calculation Exceljet

Taxtips Ca Business 2020 Corporate Income Tax Rates

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

What Are Marriage Penalties And Bonuses Tax Policy Center